Page 150 - THE MARKET WHISPERER

P. 150

148 PART 5 - Principles O f Technical Analysis

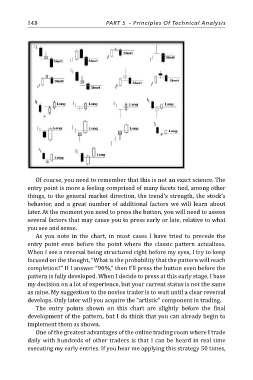

Of course, you need to remember that this is not an exact science. The

entry point is more a feeling comprised of many facets tied, among other

things, to the general market direction, the trend’s strength, the stock’s

behavior, and a great number of additional factors we will learn about

later. At the moment you need to press the button, you will need to assess

several factors that may cause you to press early or late, relative to what

you see and sense.

As you note in the chart, in most cases I have tried to precede the

entry point even before the point where the classic pattern actualizes.

When I see a reversal being structured right before my eyes, I try to keep

focused on the thought, “What is the probability that the pattern will reach

completion?” If I answer “90%,” then I’ll press the button even before the

pattern is fully developed. When I decide to press at this early stage, I base

my decision on a lot of experience, but your current status is not the same

as mine. My suggestion to the novice trader is to wait until a clear reversal

develops. Only later will you acquire the “artistic” component in trading.

The entry points shown on this chart are slightly before the final

development of the pattern, but I do think that you can already begin to

implement them as shown.

One of the greatest advantages of the online trading room where I trade

daily with hundreds of other traders is that I can be heard in real time

executing my early entries. If you hear me applying this strategy 50 times,