Page 152 - THE MARKET WHISPERER

P. 152

150 PART 5 - Principles O f Technical Analysis

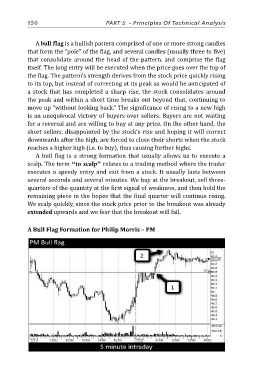

A bull flag is a bullish pattern comprised of one or more strong candles

that form the “pole” of the flag, and several candles (usually three to five)

that consolidate around the head of the pattern, and comprise the flag

itself. The long entry will be executed when the price goes over the top of

the flag. The pattern’s strength derives from the stock price quickly rising

to its top, but instead of correcting at its peak as would be anticipated of

a stock that has completed a sharp rise, the stock consolidates around

the peak and within a short time breaks out beyond that, continuing to

move up “without looking back.” The significance of rising to a new high

is an unequivocal victory of buyers over sellers. Buyers are not waiting

for a reversal and are willing to buy at any price. On the other hand, the

short sellers, disappointed by the stock’s rise and hoping it will correct

downwards after the high, are forced to close their shorts when the stock

reaches a higher high (i.e. to buy), thus causing further highs.

A bull flag is a strong formation that usually allows us to execute a

scalp. The term “to scalp” relates to a trading method where the trader

executes a speedy entry and exit from a stock. It usually lasts between

several seconds and several minutes. We buy at the breakout, sell three-

quarters of the quantity at the first signal of weakness, and then hold the

remaining piece in the hopes that the final quarter will continue rising.

We scalp quickly, since the stock price prior to the breakout was already

extended upwards and we fear that the breakout will fail.

A Bull Flag Formation for Philip Morris – PM