Page 145 - THE MARKET WHISPERER

P. 145

THE MARKET WHISPERER 14 3

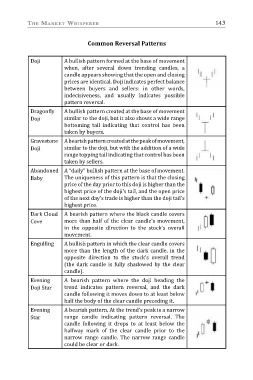

Common Reversal Patterns

Doji A bullish pattern formed at the base of movement

when, after several down trending candles, a

candle appears showing that the open and closing

prices are identical. Doji indicates perfect balance

between buyers and sellers: in other words,

indecisiveness, and usually indicates possible

pattern reversal.

Dragonfly A bullish pattern created at the base of movement

Doji similar to the doji, but it also shows a wide range

bottoming tail indicating that control has been

taken by buyers.

Gravestone A bearish pattern created at the peak of movement,

Doji similar to the doji, but with the addition of a wide

range topping tail indicating that control has been

taken by sellers.

Abandoned A “daily” bullish pattern at the base of movement.

Baby The uniqueness of this pattern is that the closing

price of the day prior to this doji is higher than the

Dark Cloud highest price of the doji’s tail, and the open price

Cove of the next day’s trade is higher than the doji tail’s

highest price.

A bearish pattern where the black candle covers

more than half of the clear candle’s movement,

in the opposite direction to the stock’s overall

movement.

Engulfing A bullish pattern in which the clear candle covers

more than the length of the dark candle, in the

opposite direction to the stock’s overall trend

(the dark candle is fully shadowed by the clear

candle).

Evening A bearish pattern where the doji heading the

Doji Star trend indicates pattern reversal, and the dark

candle following it moves down to at least below

half the body of the clear candle preceding it.

Evening A bearish pattern. At the trend’s peak is a narrow

Star range candle indicating pattern reversal. The

candle following it drops to at least below the

halfway mark of the clear candle prior to the

narrow range candle. The narrow range candle

could be clear or dark.