Page 146 - THE MARKET WHISPERER

P. 146

144 PART 5 - Principles O f Technical Analysis

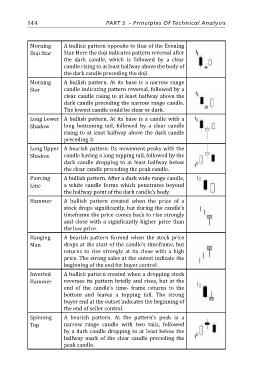

Morning A bullish pattern opposite to that of the Evening

Doji Star Star. Here the doji indicates pattern reversal after

the dark candle, which is followed by a clear

candle rising to at least halfway above the body of

the dark candle preceding the doji.

Morning A bullish pattern. At its base is a narrow range

Star candle indicating pattern reversal, followed by a

clear candle rising to at least halfway above the

dark candle preceding the narrow range candle.

The lowest candle could be clear or dark.

Long Lower A bullish pattern. At its base is a candle with a

Shadow long bottoming tail, followed by a clear candle

rising to at least halfway above the dark candle

preceding it.

Long Upper A bearish pattern. Its movement peaks with the

Shadow candle having a long topping tail, followed by the

dark candle dropping to at least halfway below

the clear candle preceding the peak candle.

Piercing A bullish pattern. After a dark wide range candle,

Line a white candle forms which penetrates beyond

the halfway point of the dark candle’s body.

Hammer A bullish pattern created when the price of a

stock drops significantly, but during the candle’s

timeframe the price comes back to rise strongly

and close with a significantly higher price than

the low price.

Hanging A bearish pattern formed when the stock price

Man drops at the start of the candle’s timeframe, but

returns to rise strongly at its close with a high

price. The strong sales at the outset indicate the

beginning of the end for buyer control.

Inverted A bullish pattern created when a dropping stock

Hammer

reverses its pattern briefly and rises, but at the

end of the candle’s time- frame returns to the

bottom and leaves a topping tail. The strong

buyer end at the outset indicates the beginning of

the end of seller control.

Spinning A bearish pattern. At the pattern’s peak is a

Top narrow range candle with two tails, followed

by a dark candle dropping to at least below the

halfway mark of the clear candle preceding the

peak candle.