Page 29 - THE MARKET WHISPERER

P. 29

28 Introduction

in the 1980s and 1990s lost everything in the decade between 2000 and

2010.

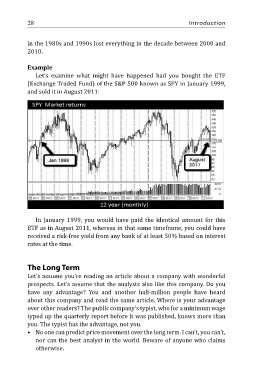

Example

Let’s examine what might have happened had you bought the ETF

(Exchange Traded Fund) of the S&P 500 known as SPY in January 1999,

and sold it in August 2011:

In January 1999, you would have paid the identical amount for this

ETF as in August 2011, whereas in that same timeframe, you could have

received a risk-free yield from any bank of at least 50% based on interest

rates at the time.

The Long Term

Let’s assume you’re reading an article about a company with wonderful

prospects. Let’s assume that the analysts also like this company. Do you

have any advantage? You and another half-million people have heard

about this company and read the same article. Where is your advantage

over other readers? The public company’s typist, who for a minimum wage

typed up the quarterly report before it was published, knows more than

you. The typist has the advantage, not you.

• No one can predict price movement over the long term. I can’t, you can’t,

nor can the best analyst in the world. Beware of anyone who claims

otherwise.