Page 108 - THE MARKET WHISPERER

P. 108

106 PART 4 - The Char t: Money ’s Footprint

producers request a simple chart prior to going on air that viewers can

understand. You’ve seen it, you’ve made this chart’s acquaintance, and

now you should forget it altogether.

Point and Figure Chart

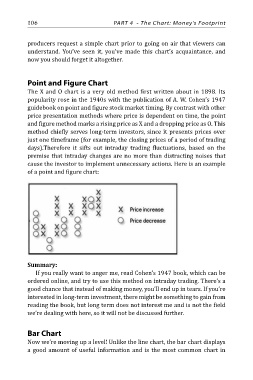

The X and O chart is a very old method first written about in 1898. Its

popularity rose in the 1940s with the publication of A. W. Cohen’s 1947

guidebook on point and figure stock market timing. By contrast with other

price presentation methods where price is dependent on time, the point

and figure method marks a rising price as X and a dropping price as O. This

method chiefly serves long-term investors, since it presents prices over

just one timeframe (for example, the closing prices of a period of trading

days).Therefore it sifts out intraday trading fluctuations, based on the

premise that intraday changes are no more than distracting noises that

cause the investor to implement unnecessary actions. Here is an example

of a point and figure chart:

Summary:

If you really want to anger me, read Cohen’s 1947 book, which can be

ordered online, and try to use this method on intraday trading. There’s a

good chance that instead of making money, you’ll end up in tears. If you’re

interested in long-term investment, there might be something to gain from

reading the book, but long term does not interest me and is not the field

we’re dealing with here, so it will not be discussed further.

Bar Chart

Now we’re moving up a level! Unlike the line chart, the bar chart displays

a good amount of useful information and is the most common chart in