Page 160 - THE MARKET WHISPERER

P. 160

158 PART 5 - Principles O f Technical Analysis

SMART Head and shoulders formations are “long range” formations

MONEY structured on multiple candles, and are therefore valid even

if they operate against the stock’s original trend.

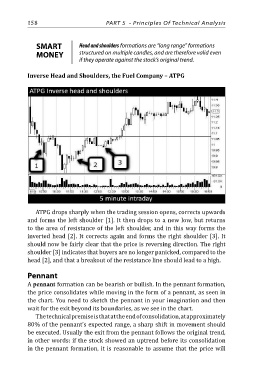

Inverse Head and Shoulders, the Fuel Company – ATPG

ATPG drops sharply when the trading session opens, corrects upwards

and forms the left shoulder [1]. It then drops to a new low, but returns

to the area of resistance of the left shoulder, and in this way forms the

inverted head [2]. It corrects again and forms the right shoulder [3]. It

should now be fairly clear that the price is reversing direction. The right

shoulder [3] indicates that buyers are no longer panicked, compared to the

head [2], and that a breakout of the resistance line should lead to a high.

Pennant

A pennant formation can be bearish or bullish. In the pennant formation,

the price consolidates while moving in the form of a pennant, as seen in

the chart. You need to sketch the pennant in your imagination and then

wait for the exit beyond its boundaries, as we see in the chart.

The technical premise is that at the end of consolidation, at approximately

80% of the pennant’s expected range, a sharp shift in movement should

be executed. Usually the exit from the pennant follows the original trend,

in other words: if the stock showed an uptrend before its consolidation

in the pennant formation, it is reasonable to assume that the price will