Page 135 - THE MARKET WHISPERER

P. 135

THE MARKET WHISPERER 13 3

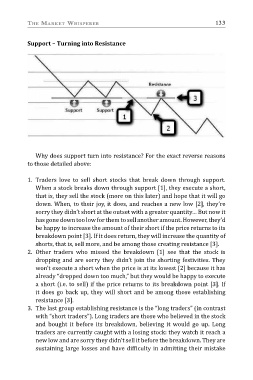

Support – Turning into Resistance

Why does support turn into resistance? For the exact reverse reasons

to those detailed above:

1. Traders love to sell short stocks that break down through support.

When a stock breaks down through support [1], they execute a short,

that is, they sell the stock (more on this later) and hope that it will go

down. When, to their joy, it does, and reaches a new low [2], they’re

sorry they didn’t short at the outset with a greater quantity… But now it

has gone down too low for them to sell another amount. However, they’d

be happy to increase the amount of their short if the price returns to its

breakdown point [3]. If it does return, they will increase the quantity of

shorts, that is, sell more, and be among those creating resistance [3].

2. Other traders who missed the breakdown [1] see that the stock is

dropping and are sorry they didn’t join the shorting festivities. They

won’t execute a short when the price is at its lowest [2] because it has

already “dropped down too much,” but they would be happy to execute

a short (i.e. to sell) if the price returns to its breakdown point [3]. If

it does go back up, they will short and be among those establishing

resistance [3].

3. The last group establishing resistance is the “long traders” (in contrast

with “short traders”). Long traders are those who believed in the stock

and bought it before its breakdown, believing it would go up. Long

traders are currently caught with a losing stock: they watch it reach a

new low and are sorry they didn’t sell it before the breakdown. They are

sustaining large losses and have difficulty in admitting their mistake