Page 129 - THE MARKET WHISPERER

P. 129

THE MARKET WHISPERER 12 7

market is neither moving up or down, but rather staying the same. A series

of similar highs and similar lows creates this movement. In the trading

room, we often describe this situation as moving sideways or moving in

the range.

SMART When the market is moving sideways, it is difficult to profit.

MONEY We can never know in advance if the market will move with

the trend or not. Once we notice that the market is trendless,

we avoid taking new trades.

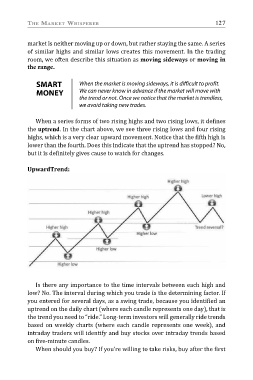

When a series forms of two rising highs and two rising lows, it defines

the uptrend. In the chart above, we see three rising lows and four rising

highs, which is a very clear upward movement. Notice that the fifth high is

lower than the fourth. Does this indicate that the uptrend has stopped? No,

but it is definitely gives cause to watch for changes.

UpwardTrend:

Is there any importance to the time intervals between each high and

low? No. The interval during which you trade is the determining factor. If

you entered for several days, as a swing trade, because you identified an

uptrend on the daily chart (where each candle represents one day), that is

the trend you need to “ride.” Long-term investors will generally ride trends

based on weekly charts (where each candle represents one week), and

intraday traders will identify and buy stocks over intraday trends based

on five-minute candles.

When should you buy? If you’re willing to take risks, buy after the first